CPD ABC

Freelancer Tax Compliance Package

Freelancer Tax Compliance Package

Couldn't load pickup availability

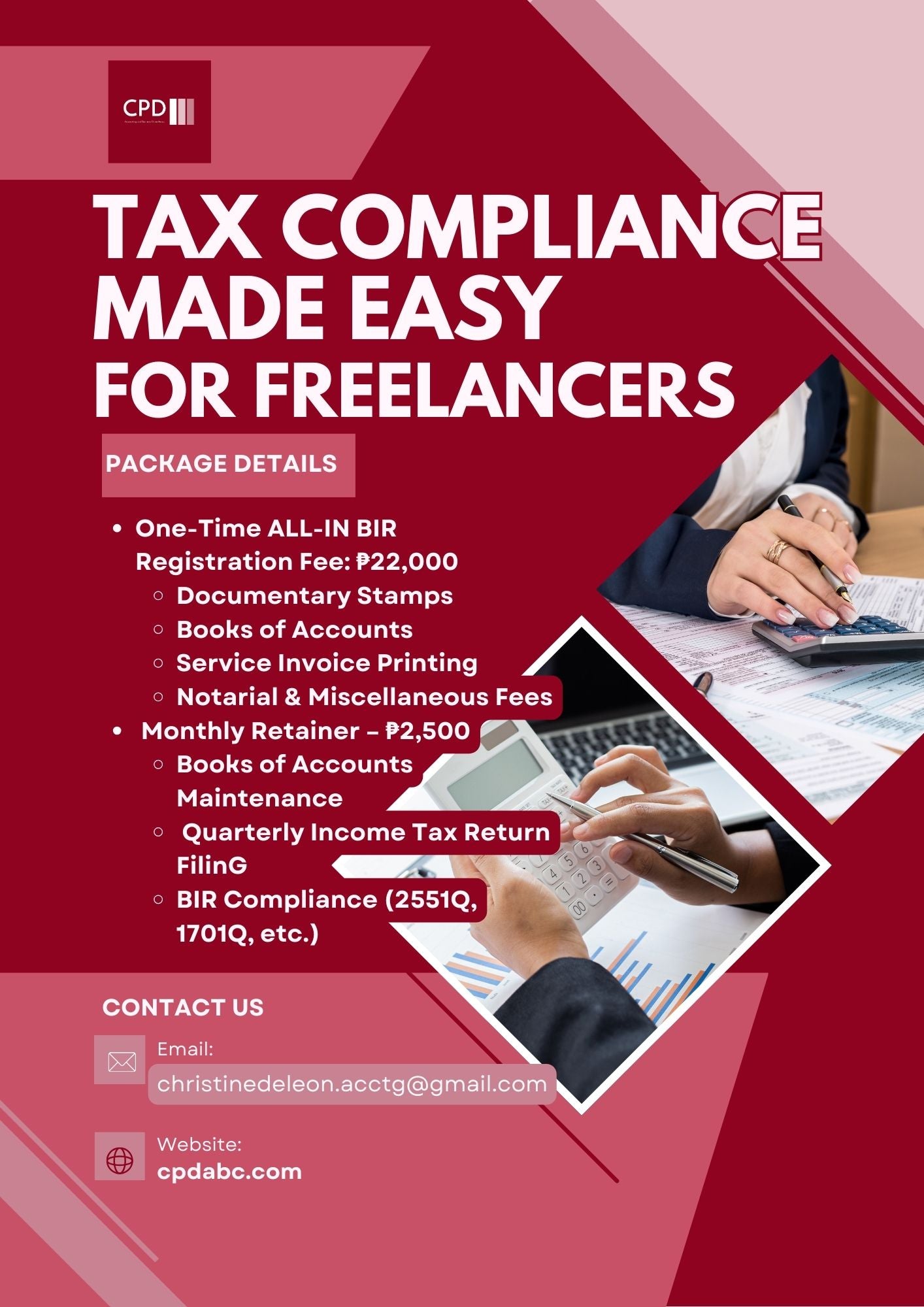

📌 Freelancer Tax Compliance Package

For self-employed professionals and freelancers who need hassle-free tax compliance.

One-Time Registration Fee: ₱12,000

(Exclusive of government fees)

✅ Assistance in BIR Registration (Form 1901)

✅ Taxpayer Identification Number (TIN) Registration (if applicable)

✅ Application for Certificate of Registration (Form 2303)

✅ Registration of Books of Accounts

✅ Application for Official Receipts/Service Invoices

✅ Business Permit Guidance (if needed)

Estimated BIR Registration Expenses: ₱10,000

🔹 Documentary Stamps

🔹 Books of Accounts

🔹 Service Invoice Printing

🔹 Notarial & Miscellaneous Fees

Total Estimated Initial Cost: ₱22,000 (₱12,000 + ₱10,000)

📅 Monthly Retainer Fee: ₱2,500

Includes:

✔ Maintenance of Books of Accounts

✔ Quarterly Income Tax Return (QITR) Filing

✔ Monthly & Quarterly BIR Filings (2551Q, 1701Q, etc.)

✔ Annual Tax Return Filing (1701)

✔ Ongoing Tax Compliance Support

Optional Add-ons (Quoted Separately):

📌 VAT Registration & Filing (if applicable)

📌 Amendments to BIR Registration

📌 Assistance with Tax Assessments & Audits

Share